Contents

- 1 Form 8865 Categories of Filers

- 2 Category 1 Filer for Form 8865

- 3 Category 2 Filer for Form 8865

- 4 Category 3 Filer for Form 8865

- 5 Category 4 Filer for Form 8865

- 6 Form 8865 Schedules

- 7 Late Filing Penalties May be Reduced or Avoided

- 8 Current Year vs Prior Year Non-Compliance

- 9 Avoid False Offshore Disclosure Submissions (Willful vs Non-Willful)

- 10 Need Help Finding an Experienced Offshore Tax Attorney?

- 11 Golding & Golding: About Our International Tax Law Firm

A Form 8865 Categories of Filers Overview (Who Must Report)

Form 8865 Categories of Filers

The Internal Revenue Service has developed several international information reporting forms for US Persons who may have foreign accounts, assets, investments, and or income. Out of all the different international information reporting forms, Form 8865 is one of the more complicated ones for the simple fact that reporting partnerships, in general, are complex. The Form is similar to Internal Revenue Service Form 5471 – noting that taxpayers who qualify as a category one file or under Form 8865 have some significant reporting they will have to do it each year. With the globalization of the US economy and more and more US persons engaging in foreign partnerships, let’s take an introductory look at the different categories of filers for Form 8865.

Category 1 Filer for Form 8865

-

-

-

A Category 1 filer is a U.S. person who controlled the foreign partnership at any time during the partnership’s tax year. Control of a partnership is ownership of more than a 50% interest in the partnership. See the definition of 50% interest, later. There may be more than one Category 1 filer for a partnership for a particular partnership tax year. See U.S. person and Foreign partnership, later.

-

A Category 1 filer also includes a U.S. transferor who must report certain information with respect to a section 721(c) partnership for the tax year of contribution and subsequent years, pursuant to Regulations section 1.721(c)-6. A Category 1 filer fulfills this reporting requirement by filing Schedule G and, in certain circumstances, Schedule H. See Section 721(c) partnership and U.S. transferor, later.

-

-

Category 2 Filer for Form 8865

-

-

-

A Category 2 filer is a U.S. person who at any time during the tax year of the foreign partnership owned a 10% or greater interest in the partnership while the partnership was controlled by U.S. persons each owning at least a 10% interest.

-

However, if the foreign partnership had a Category 1 filer at any time during that tax year, no person will be considered a Category 2 filer. See the definition of a 10% interest, later.

-

-

Category 3 Filer for Form 8865

-

-

-

A Category 3 filer is a U.S. person who contributed property during that person’s tax year to a foreign partnership in exchange for an interest in the partnership (a section 721 transfer), if that person either: 1. Owned directly or constructively at least a 10% interest in the foreign partnership immediately after the contribution, or 2.

-

The value of the property contributed (when added to the value of any other property contributed to the partnership by such person, or any related person, during the 12-month period ending on the date of transfer) exceeds $100,000. If a domestic partnership contributes property to a foreign partnership, the domestic partnership’s partners are considered to have transferred a proportionate share of the contributed property to the foreign partnership. However, if the domestic partnership files Form 8865 and properly reports all the required information with respect to the contribution, its partners will not be required to report the transfer.

-

A Category 3 filer includes a U.S. transferor who

-

(i) contributes section 721(c) property to a section 721(c) partnership, and

-

(ii) has reporting requirements pursuant to Regulations section 1.721(c)-6(b)(2). The Category 3 filer fulfills this reporting requirement by filing Schedule G, in addition to Schedule O, and, in certain circumstances, Schedule H. See Section 721(c) property, later.

-

-

Category 3 also includes a U.S. person that previously transferred appreciated property to the partnership and was required to report that transfer under section 6038B, if the foreign partnership disposed of such property while the U.S. person remained a direct or indirect partner in the partnership.

-

-

-

Category 4 Filer for Form 8865

-

-

-

A Category 4 filer is a U.S. person that had a reportable event under section 6046A during that person’s tax year. There are three categories of reportable events under section 6046A: acquisitions, dispositions, and changes in proportional interests. Acquisitions. A U.S. person that acquires a foreign partnership interest has a reportable event if:

-

The person didn’t own a 10% or greater direct interest in the partnership and, as a result of the acquisition, the person owns a 10% or greater direct interest in the partnership (for example, from 9% to 10%). For purposes of this rule, an acquisition includes an increase in a person’s direct proportional interest (see Changes in proportional interests, later); or

-

Compared to the person’s direct interest when the person last had a reportable event, after the acquisition the person’s direct interest has increased by at least a 10% interest (for example, from 11% to 21%). An acquisition of a section 721(c) partnership interest may be an acceleration event exception under the gain deferral method. See Regulations section 1.721(c)-5. In this case, the acquirer may become a successor U.S. transferor and may have a reporting requirement under Regulations section 1.721(c)-6. See the specific instructions for Schedule H, later. Dispositions. A U.S. person that disposes of a foreign partnership interest has a reportable event if:

-

The person owned a 10% or greater direct interest in the partnership before the disposition and, as a result of the disposition, the person owns less than a 10% direct interest (for example, from 10% to 8%). For purposes of this rule, a disposition includes a decrease in a person’s direct proportional interest; or • Compared to the person’s direct interest when the person last had a reportable event, after the disposition the person’s direct interest has decreased by at least a 10% interest (for example, from 21% to 11%).

-

A disposition of a section 721(c) partnership interest may be an acceleration event for purposes of applying the gain deferral method. The U.S. transferor may be required to recognize gain in an amount equal to the remaining built-in gain on the section 721(c) property previously contributed to the section 721(c) partnership. See Regulations section 1.721(c)-4.

-

For acceleration events exceptions, see Regulations section 1.721(c)-5. See the specific instructions for Schedule H, later. Changes in proportional interests. A U.S. person has a reportable event if compared to the person’s direct proportional interest the last time the person had a reportable event, the person’s direct proportional interest has increased or decreased by at least the equivalent of a 10% interest in the partnership.

-

-

-

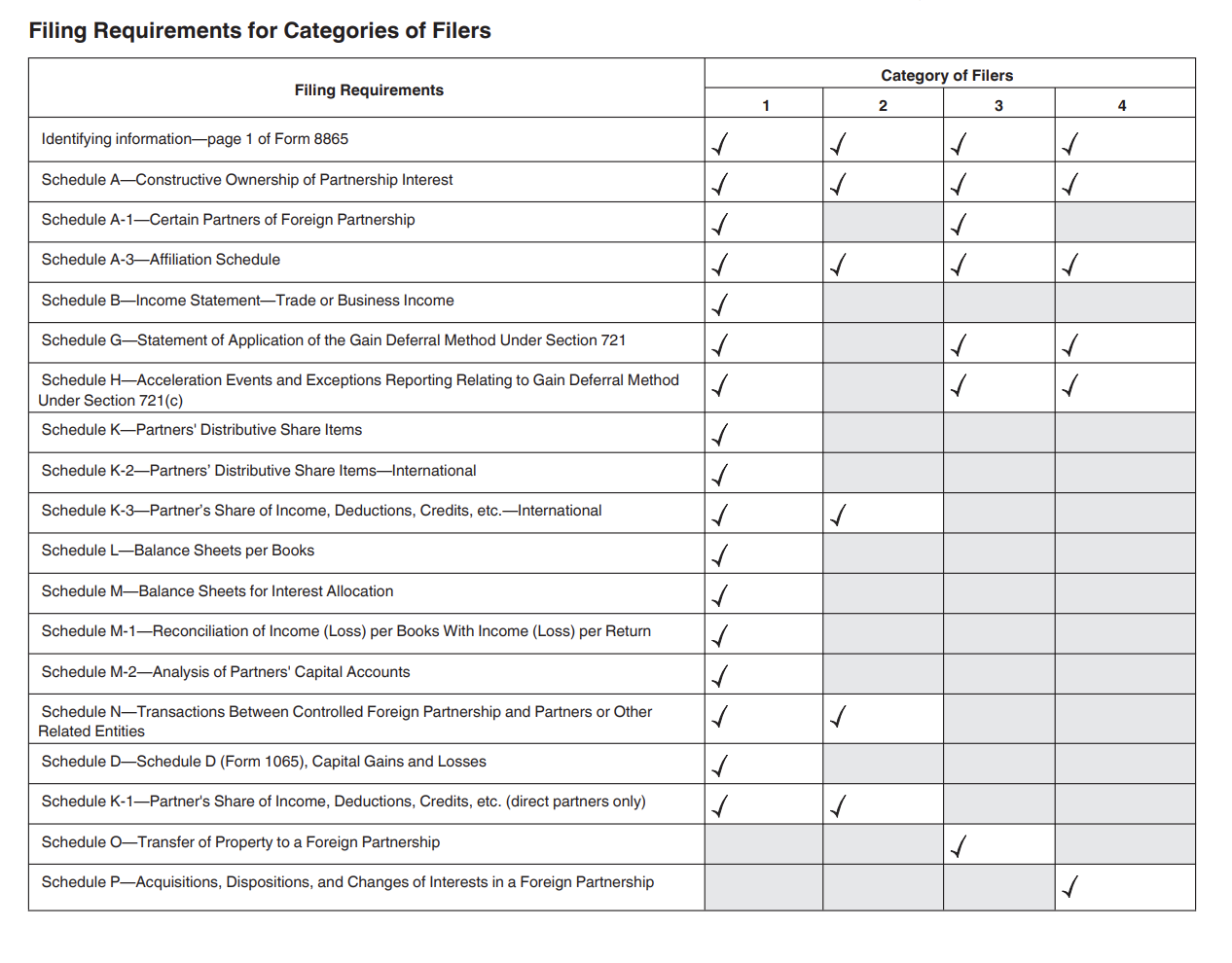

Form 8865 Schedules

Late Filing Penalties May be Reduced or Avoided

Late Filing Penalties May be Reduced or Avoided

For Taxpayers who did not timely file their FBAR and other international information-related reporting forms, the IRS has developed many different offshore amnesty programs to assist taxpayers with safely getting into compliance. These programs may reduce or even eliminate international reporting penalties.

Current Year vs Prior Year Non-Compliance

Once a taxpayer missed the tax and reporting (such as FBAR and FATCA) requirements for prior years, they will want to be careful before submitting their information to the IRS in the current year. That is because they may risk making a quiet disclosure if they just begin filing forward in the current year and/or mass filing previous year forms without doing so under one of the approved IRS offshore submission procedures. Before filing prior untimely foreign reporting forms, taxpayers should consider speaking with a Board-Certified Tax Law Specialist who specializes exclusively in these types of offshore disclosure matters.

Avoid False Offshore Disclosure Submissions (Willful vs Non-Willful)

In recent years, the IRS has increased the level of scrutiny for certain streamlined procedure submissions. When a person is non-willful, they have an excellent chance of making a successful submission to Streamlined Procedures. If they are willful, they would submit to the IRS Voluntary Disclosure Program instead. But, if a willful Taxpayer submits an intentionally false narrative under the Streamlined Procedures (and gets caught), they may become subject to significant fines and penalties.

Need Help Finding an Experienced Offshore Tax Attorney?

When it comes to hiring an experienced international tax attorney to represent you for unreported foreign and offshore account reporting, it can become overwhelming for taxpayers trying to trek through all the false information and nonsense they will find in their online research. There are only a handful of attorneys worldwide who are Board-Certified Tax Specialists and who specialize exclusively in offshore disclosure and international tax amnesty reporting.

Golding & Golding: About Our International Tax Law Firm

Golding & Golding specializes exclusively in international tax, specifically IRS offshore disclosure.

Contact our firm today for assistance.